Energy demand in Asia-Pacific countries is expected to rise as the population grows and living standards improve. At the same time, many nations in the region have set a goal of becoming carbon-neutral within a few decades, in line with the Paris Agreement.

Businesses including ExxonMobil are evolving to meet those needs with lower-carbon solutions including wind and solar, utilising technology like carbon capture and storage, or CCS, to drive down carbon emissions.

ExxonMobil launched its new Low Carbon Solutions business earlier this year to focus on CCS, which targets high-emission sectors that are especially hard to decarbonise, such as power generation and industrial manufacturing.

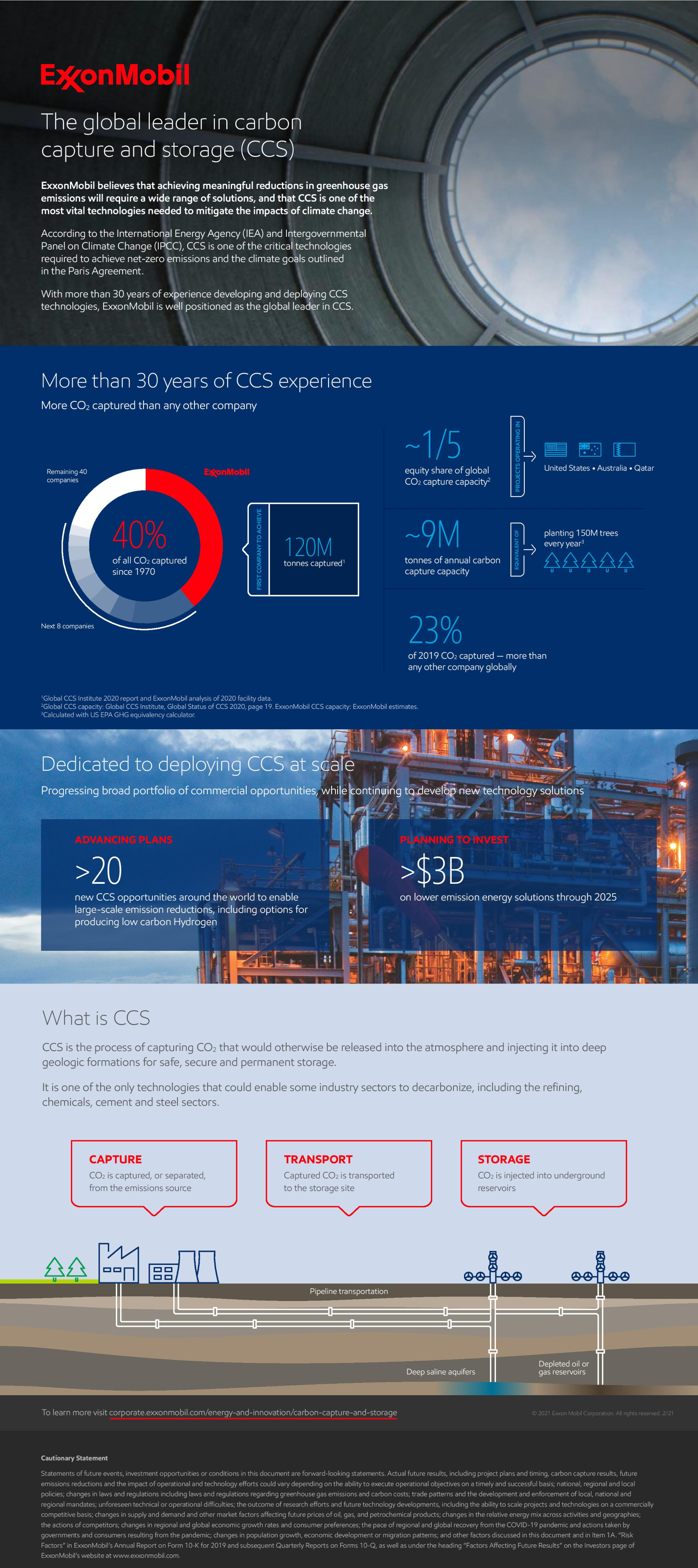

CCS works by capturing CO2 that would otherwise be released into the atmosphere from industrial activity and then putting it back into the earth, injecting it into deep geologic formations for safe, secure and permanent storage.

It’s a critical technology for reducing CO2 emissions at the lowest cost to society, said Fatih Birol, executive director of the International Energy Agency.

“Without CCS as part of the solution, meeting global climate goals will be practically impossible,” he said.

Achieving these goals should also be supported by policies that help to spur the investment required to deploy CCS on a pace and scale to meet the Paris Agreement benchmarks. Governments should establish durable regulatory and legal environments and implement policies to enable CCS to receive direct investment and incentives similar to those available to other efforts to reduce emissions.

Establishing market prices on carbon will play an important part by providing the needed clarity and stability required to drive investment.

Leading development

ExxonMobil has more than three decades of experience in CCS technology. It was the first company to capture more than 120 million metric tons of CO2, equal to the emissions of more than 25 million cars over one year, and it has captured about 40% of all the human-made CO2 in history.

The Low Carbon Solutions business will also take advantage of the company’s experience in making hydrogen, another energy source likely to play a critical role in the years to come. ExxonMobil plans more than $US3 billion of investments in lower-emission energy sources through 2025.

The new business shows that “ExxonMobil is committed to meeting the demand for affordable energy while reducing emissions and managing the risks of climate change,” said Darren Woods, chairman and chief executive officer of ExxonMobil. “We have the expertise that can help bring technologies to market and make a meaningful difference.”

LCS is already evaluating plans for multiple CCS opportunities in places around the world, including:

- Singapore – ExxonMobil is assessing the potential for a CCS hub to capture, transport and store CO2 generated by industrial activity in the Asia-Pacific region. The concept is based on a plan to capture CO2 emissions from Singapore manufacturing facilities.

- Netherlands – ExxonMobil has an interest in the Port of Rotterdam CO2 Transportation Hub and Offshore Storage project, known as Porthos. The Porthos project aims to collect CO2 emissions from industrial sources and transport them by pipeline to depleted North Sea offshore gas fields. It also participates in the H-Vision study into large-scale production of low-carbon hydrogen in Rotterdam.

- Belgium – ExxonMobil is participating in the multi-stakeholder CCS project at the Port of Antwerp, Europe’s largest integrated energy and chemicals cluster. The project would collect CO2 emissions from industrial sources for storage.

- Scotland – Through its joint venture in the SEGAL system in Northeast Scotland, ExxonMobil is progressing discussions to support the Acorn project, which will collect CO2 from the St. Fergus gas processing complex for transport and storage in offshore gas reservoirs.

- Qatar – ExxonMobil is a partner in several existing joint ventures with Qatar Petroleum that operate a CCS project with an annual capacity of 2.1 million metric tons at Ras Laffan. It is studying ways to add capture capacity there.

- U.S. Gulf Coast – ExxonMobil is assessing the development of a large-scale CCS hub concept that could effectively decarbonize the heavy-industry area in and around the Houston Ship Channel.

- Wyoming, U.S. – ExxonMobil is making progress on acquiring permits to expand its LaBarge CCS facilities, which could enable the capture of an additional 1 million metric tons of CO2 per year. The project now captures about 7 million tons of CO2 a year, the most of any industrial facility in the world.

Since 2000, ExxonMobil has spent more than US$10 billion to develop and deploy higher-efficiency and lower-emission energy solutions across its operations. The company works with about 80 universities in the United States, Europe and Asia to explore next-generation energy technologies.

ExxonMobil is also collaborating with multiple partners across industry, academia and government to make capturing CO2 less expensive and more efficient. This includes the company’s work with FuelCell Energy on capturing CO2 from industrial plants and with Global Thermostat on capturing CO2 out of the air.

The company’s history of innovation and expertise in science, research and technology gives it a competitive edge as the Asia-Pacific region and the world advance toward a low-carbon future.